Insurance Licence Authorisation: Part III - Regulatory Focus Areas

The previous article described how the authorisation process operates and where execution commonly breaks down. Beneath that process, however, sits a relatively consistent set of supervisory priorities that ultimately determine outcomes.

This article examines the core regulatory focus areas that shape how applications are assessed in Ireland — including business model sustainability, governance, capital, outsourcing, and recovery planning — and explains why these themes matter from a supervisory perspective.

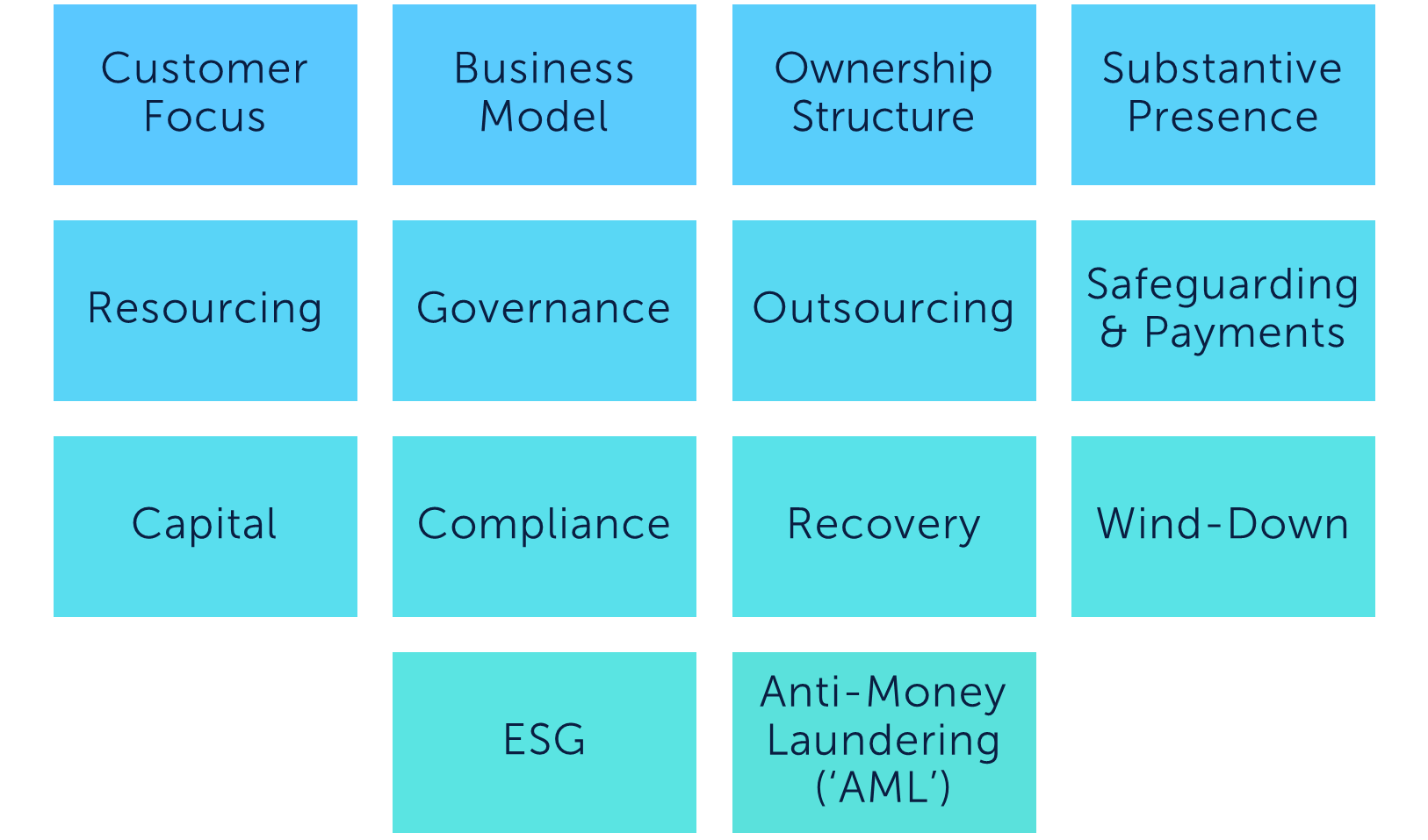

Common Regulatory Focus Areas

The CBI’s supervisory approach is distinctive and firmly established. To facilitate a smooth authorisation process and effective post-authorisation supervision, every application should clearly address the key regulatory focus areas prioritised by the CBI.

Customer Focus

The CBI expects undertakings to place customer interests at the heart of their business models. This includes clearly demonstrating the target market for the product or service envisioned by the proposed business model, as well as the specific benefits that the service provides to that target market. Even when undertakings outsource significant components of their customer interaction model, insurers must still ensure that oversight practices for such intermediaries are designed with the customers’ best interests in mind.

In summary, while outsourcing of activities is permitted, ultimate responsibility and accountability can never be outsourced.

Business Model

The CBI reviews proposed business models to assess their viability, including the sustainability of the applicant’s strategy to generate credible returns over a forward-looking period. Applicant firms should present a clear business strategy and a business plan that demonstrates their model is capital accretive over the long term.

Ownership Structure

Applicant firms must be able to demonstrate a clear ownership structure, up to, and including ultimate beneficial owners. Any potential conflicts of interest created by ownership structures should be identified within the business plan.

Substantive Presence

Provision of management activities or services from outside the State is not prohibited and, in fact, is commonplace among Irish insurance undertakings. However, applicants must demonstrate that they maintain sufficient substance within the State of Ireland. This requires providing evidence of an appropriate level of presence in Ireland. Substance entails having a meaningful and substantive presence in the jurisdiction, managing key risks from within the entity, and ensuring that key decisions are made by individuals within the entity itself, rather than elsewhere within a group.

Resourcing

Applicants should demonstrate that they have adequate resources, commensurate to the nature, scale and complexity of their business activities and the risks therein. Applicant firms must have adequate and sufficient resources with appropriate compliance expertise in place to review and assess the applicant’s compliance risks.

Governance

Applicants must demonstrate that their governance structures are appropriate to the nature, scale, and complexity of their intended operations. In most cases, this will require implementing a well-resourced “three lines of defence” model.

Outsourcing

Applicant firms should demonstrate that they have the capability to fully manage any outsourced activities. Responsibility for the operation or management of key functions must remain wholly with the applicant.

The CBI has issued Cross Industry Guidance on Outsourcing which should be considered as part of the application process.

Safeguarding & Payments

Where applicable, applicants should evidence suitable arrangements to safeguard customers’ funds. In an insurance context, this means that robust policies and procedures are in place to ensure any policyholder claims can be met as and when they fall due.

Capital

Applicants must have robust capital, governance and planning systems in place, and, therefore, be able to demonstrate and substantiate that they will have adequate and timely sources of funding.

Firms should be able to demonstrate that they have sufficient financial resources under a plausible but severe stress scenario. In an insurance context, this is demonstrated through the Own Risk and Solvency Assessment (‘ORSA’), evidencing the firm can meet its capital requirements, now and into the future, under a wide range of stresses and scenarios.

Compliance

Applicant firms must have adequate and sufficient frameworks in place to assess the applicant’s compliance risks and to monitor the adequacy and effectiveness of its compliance monitoring processes and its on-going compliance with its legal and regulatory obligations.

Compliance expectations of insurance undertakings are substantially more complex than reinsurance undertakings owing to the conduct risk associated with insurance activities.

Recovery

Applicants should demonstrate the ability to recover critical or important business services from a significant unplanned disruption, while minimising impact and protecting their customers.

Recovery could mean restoration of normal activities from (i) loss of capital resources, (ii) loss of IT systems, (iii) loss of key staff, or (iv) loss of key service providers.

The CBI has issued Cross Industry Guidance on Operational Resilience which should be considered as part of the application process.

Wind-Down

A firm should have plans in place to ensure that it can exit the market in a safe and orderly manner demonstrated through an effective wind down plan which minimises client detriment.

ESG

Applicant firms must have a robust framework in place to effectively identify and manage risks relating to ESG and to ensure that the disclosures made are clear and not misleading.

Anti-Money Laundering (‘AML’)

Firms must demonstrate that strong risk management practices and internal controls are in place in order to ensure compliance with the Criminal Justice (Money Laundering and Terrorist Financing) Act 2010 (as amended).

AML is a more significant consideration for insurance undertakings than it is reinsurers. Furthermore, non-life firms are typically not subject to the same scrutiny and obligations as life insurers.

Part III Summary

The regulatory focus areas outlined above are not abstract principles. They are the lenses through which authorisation applications are assessed and the benchmarks against which supervisory confidence is formed.

In Part IV of the series, these supervisory priorities are translated into practice. We set out the full authorisation application pack required by the Central Bank of Ireland, showing how expectations around governance, capital, risk management, outsourcing, and operational resilience are evidenced through documentation and formal submissions.

Taken together, this shift from focus areas to application requirements highlights a critical point: successful authorisation in Ireland depends not on addressing each requirement in isolation, but on presenting a coherent, credible operating model that can be supervised effectively over time.